Change in Retained Earnings

Alphabet supports and develops companies applying technology to. 1 The two types of emergency procedures are.

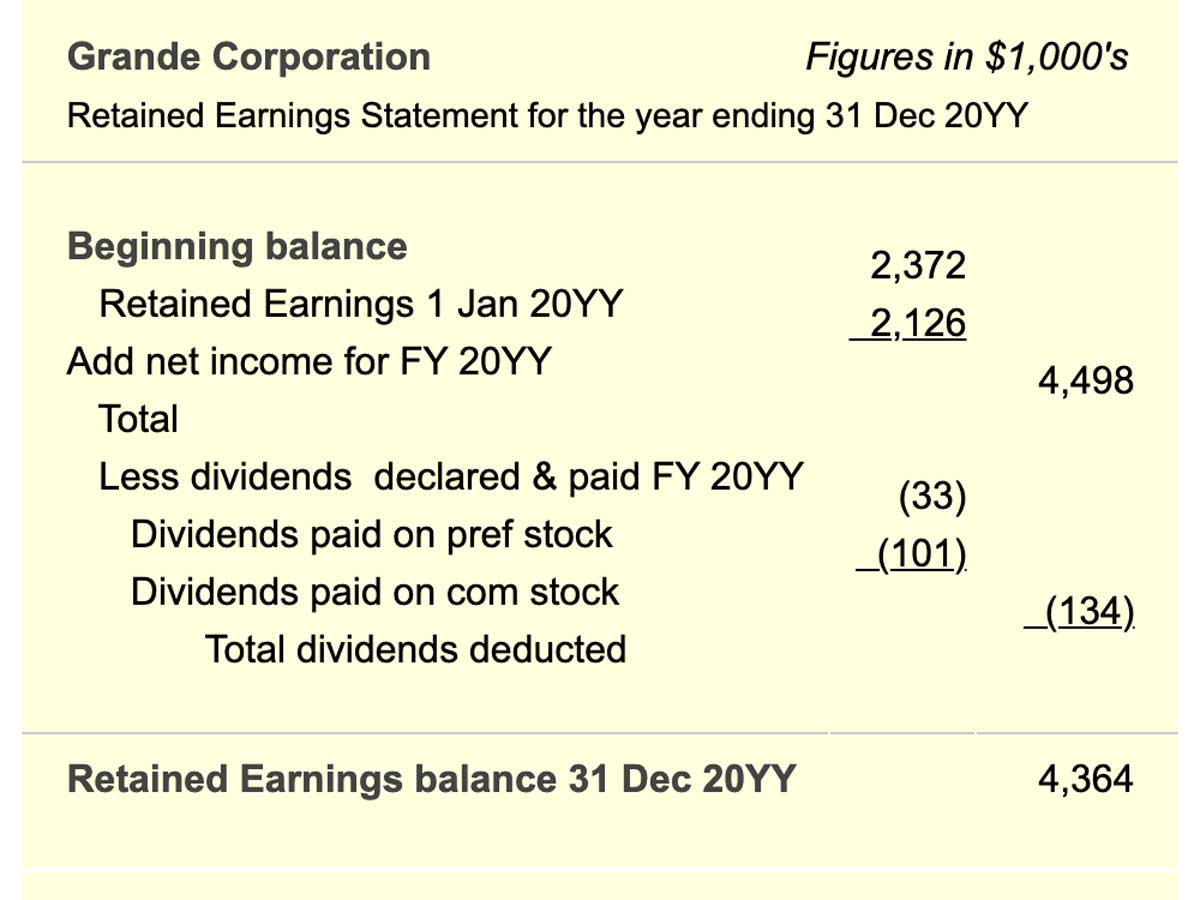

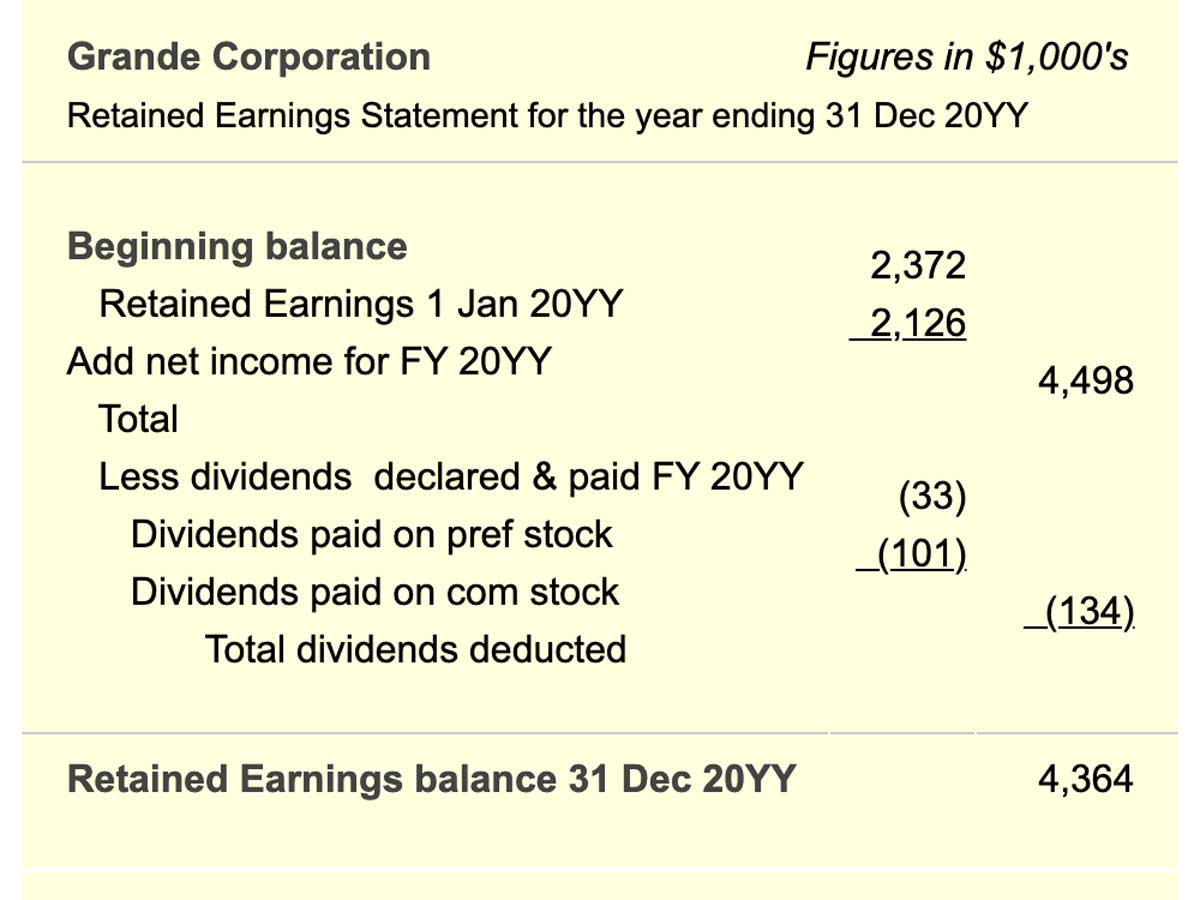

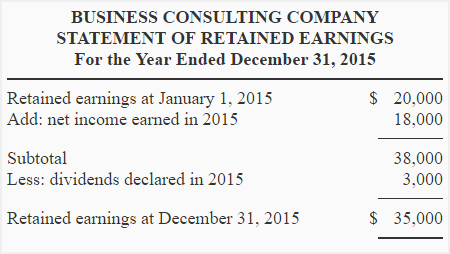

Statement Of Retained Earnings Reveals Distribution Of Earnings

As the company becomes profitable the roll-forward of corporate profits.

. Private companies may need to distribute quarterly or annual financial reports to banks or lenders. The template features a single worksheet tab that contains a table of the statement itself. The 1120S schedule M-2 analyzes adjustments to the accumulated earnings account other adjustments account and previously taxed income account.

Balance sheet income statement cash flow earnings estimates ratio and margins. The difference in the beginning inventory for 20X5 would cause net income to decrease by 400 while the difference in the 20X5 ending inventory would cause net income to increase by 4000. A live audio webcast of our second quarter 2022 earnings release call will be available on YouTube at https.

It is the minimum return that investors expect for providing capital to the company thus setting a benchmark that a new. View AMZN financial statements in full. We would like to show you a description here but the site wont allow us.

It is used to evaluate new projects of a company. So what does it mean if retained earnings are negative. In some cases the discovery of errors make a retained earnings adjustment necessary to correct mistakes.

The table is divided into columns. This kind of adjustment is called a prior period adjustment because it represents a change resulting from the activity or the records of a prior accounting cycle. Preferred Stock Common Stock Additional Paid-In Capital Retained Earnings Accumulated Deficit and Total.

Change in Accounting Method. An adjustment to retained earnings will be necessary to account for the effect of the inventory method change on 20X5 net income. Emergency conditions associated with a problem or failing banking organization may allow for processing of an application under the streamlined procedures of the Bank Holding Company Act the Federal Deposit Insurance Act the Change in Bank Control Act or the Federal Reserve Act.

The corporation must have retained more earnings and profits than. It has no counterpart on Form 1120 because a C corporation does not have these accounts. Retained earnings 191484 196845 Total stockholders equity 251635 255419 Total liabilities and stockholders equity 359268 355185.

The rows meanwhile show the Beginning Balance Issuance of Stock Net Income or Net Loss and Dividends. To keep or continue to have something. Retained EPS.

Still some companies will borrow money specifically to pay a. Calculating retained earnings per share requires taking the net earnings number adding any currently held retained earnings subtracting the total amount of dividends paid out and. Is a holding company that gives ambitious projects the resources freedom and focus to make their ideas happen and will be the parent company of Google Nest and other ventures.

Alternative Treatment of Common Improvements Under Rev. For example if a corporation had 250000 in retained earnings at periods start earned 80000 in net income. Negative retained earnings are a common occurrence for startups and unprofitable companies.

It is not a reconciliation of retained earnings as the schedule M-2 is for an 1120. Add the change in retained earnings to retained earnings at the start of the period. A financial report or financial statement consists of a balance sheet an income statement a statement of retained earnings and a statement of cash flowsThese 4 documents together communicate a companys performance over a period of time.

Stock-based compensation impairments and write-downs are all examples of non-cash items that can have an effect on the net income which will then cause a change to the retained earnings. Since all profits and losses flow through retained earnings any change in the income statement item would impact the net profitnet loss part of the retained earnings formula. The company wont always have actual cash to pay a dividend even if the retained earnings line item on its balance sheet is positive.

Dividends paid are the cash and stock dividends paid to the stockholders of your company during an accounting period. In economics and accounting the cost of capital is the cost of a companys funds both debt and equity or from an investors point of view is the required rate of return on a portfolio companys existing securities. If a company operates at a net loss the net losses will result in a negative retained earnings account on the balance sheet.

Change in constant currency revenues year over year1 2 57 16. Kroger shares were marked 56 higher in mid-day trading following the earnings release to change hands at 5102each trimming the stocks six-month decline to around 8. In order to get an accurate picture of an organizations financial position it is important to look at the entire balance sheet including the gross and net.

Revenue and retained earnings provide insights into a companys financial performance. The full-year consolidated earnings forecast for the fiscal year ending February 28 2023 is net sales of 4962 million yen 298 from the previous year operating income of 400 million yen. Revenue is a critical component of the income statement.

If a substance retains something such as heat or. Where cash dividends are paid out in cash on a per.

Statement Of Retained Earnings Explanation Format Example Formula Accounting For Management

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

What Are Retained Earnings Guide Formula And Examples

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Retained Earnings Formula And Calculator Excel Template

0 Response to "Change in Retained Earnings"

Post a Comment